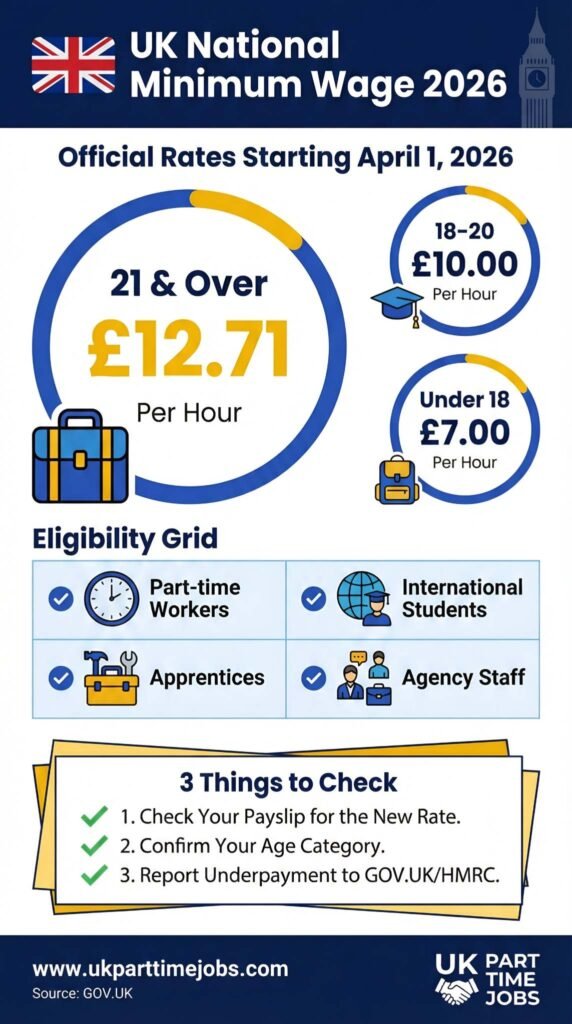

If you are an employed part-time worker, the UK National Minimum Wage 2026 update will definitely cheer you up. From April 2026, the UK Government is going to introduce a revised National Minimum Wage rate. These increased minimum wage rates will be good for millions of workers across the UK who are employed for part time work. With the rising cost of living, it was an important step by the UK government. The increased wage rates will apply in England, Wales, Scotland and Northern Ireland. In this guide, you will find the new wage rates and their applicability to the part time roles.

Official UK National Minimum Wage 2026 Pay Rates Table

Although these rates will apply to working class people who are employed full time, part time and on a temporary contract, the workers with the age 21 and above will benefit the most with the part time pay rates UK. For the part time employees, the pay would be calculated based on the hours of their work. Following is a table of UK minimum Wage rates 2026:

| Category of Worker | Hourly Rates (2026) | |

| 1. | Age 21 and over | £ 12.71 |

| 2. | Age 18 – 20 | £ 10.85 |

| 3. | Under 18 | £ 8.00 |

| 4. | Apprentices | £ 8.00 |

In this table, you can clearly see the distinction between the age groups and the wages paid for each age group. For age 21 and over, the wage is equal to the national living wage 2026.

These updated rates have a big impact on the part time workers. The part time workers usually have irregular hours , different shifts and inconsistent income. With the UK minimum wage 2026, the part time workers will benefit the most. They will be paid the right wage according to the work they have completed. Now the employees won’t be able to make an average pay over a long period of time and make underpayments.

Another piece of good news is that the unpaid duties, like attending the training or other tasks, will be included in the paid hours. In the sectors where part time workers usually work, like retail, care, hospitality and education, it is important for workers to understand the part time pay rates UK.

Legal Protection for Underpaid Workers

There are many laws in the UK that prevent the harassment of workers by paying them a lower wage than decided by the government. For example, the employers are now required to keep an inventory of the actual hours the workers put into their effort for the work. If any employer fails to maintain the inventory, they can be subjected to public naming, mandatory repayment according to accurate wages and even fines.

When the worker is underpaid, they can apply to recover the shortfall, no matter how long the time period is. This rule is applicable to all the employees covered under national living wage 2026 and lower age groups. The employers now won’t be able to deduct the cost of the equipment usage, uniforms and training fee. So, the employees will be paid the wage in full. Along with this, any tips or service charges cannot be counted as a wage under the new law.

Guidance for Underpaid Workers

If any worker feels like they are being underpaid, they should first review the payslips and match it with their working hours. It is advised that the workers should always keep a record of their working hours. If they find any anomaly, they should inform the employer about it and ask for the right wage. If the issue is not resolved by communicating it with the employer, the workers are eligible to contact the HM revenue and customs (HMRC). The HMRC will then look into the matter and inquire into the whole situation. They will impose the fine and enforce repayment to the employee. This leads to workers getting repayment under the UK minimum wage 2026 rules.

Read Also: Part Time Cleaning Jobs UK: Easiest Way to Start Working 2026

Why the UK National Minimum Wage 2026 Increase Matters

With the ongoing increased economic pressure and inflation in household costs, the 2026 update in wages is an important decision by the government. Especially for the part time workers, the hourly increase in wage can increase their monthly income significantly. The national living wage 2026 also represents a policy shift that would enhance protection for the part time employees. With the awareness of their rights, workers won’t be underpaid anymore.

Conclusion

The National Minimum Wage update for April 2026 is a strong step towards granting fair pay, especially to the part time workers. The workers can get information regarding the new rates, check their pay carefully and get knowledge on how the pay enforcement works. This will ensure the right payment to the employees according to the law. We urge all employees to gain knowledge about the part time pay rates UK so that they can avail the full benefit of their legal rights.

Read how to apply for an NI number here

[…] UK National Minimum Wage 2026: A Complete Guide for Part-Time Workers […]